Oil slips as trade war worries outweigh Iran sanctions

Oil prices slipped on Friday as concerns over the impact of a global trade war depressed sentiment, although impending U.S. sanctions on Iran and falling Venezuelan output limited losses. ✔ However oil markets are tightening with a recent surplus draining, trade figures show ✔ Brent prices will exceed $80 per barrel before the end of the year, U.S. bank Jefferies forecast on Friday ✔ Crude oil futures trading volumes: tmsnrt.rs/2P2ZZJz Our Standards:The Thomson Reuters Trust Principles

European shares slide on trade war threats, Whitbread soars on...

European shares tumbled for a second day on Friday as reports that U.S. President Donald Trump is planning further tariffs on China heated up a trade war, while Whitbread stole the spotlight after clinching a $5.1 billion deal with Coca-Cola. ✔ Traders said the deal value exceeded the market’s expectations by 500 to 900 million pounds, and was wrapped up more quickly than forecast ✔ Whitbread aside, there were many substantial falls across the European market ✔ Our Standards:The Thomson Reuters Trust Principles

Markets Now: Dow Drops 51 Points Because the Trade War Isn’t Over

Stocks continued to sink on trader concerns. ✔ Check back here for a semi-live look at the volatile markets from Barron's reporters ✔ The president’s observation that the EU is 'almost as bad as China, just smaller,' confirms that even 0% auto tariffs won’t be enough of a European concession to achieve a compromise

Coca-Cola-Costa, Trade War Threats, BlackRock and Tesla: CEO Daily for August 31, 2018

Must-read business news, delivered every morning. ✔ Tesla said 17 million shares backed the proposal, while 86 million voted against it ✔ Reuters Wells Fed Up More than a dozen employeesfrom analysts to managing directorsof the Wells Fargo investment bank have been suspended or shown the door after the company cracked down on after-hours meal expenses ✔ The move is seeing a lot of pushback, even from some Republicans ✔ Find previous editions here, and sign up for other Fortune newsletters here

GOLDMAN SACHS: Buying these 13 stocks will help you crush the market as Trump's trade war heats up

BI PRIME: President Donald Trump has once again upped the stakes of a global trade showdown with China, which is sure to put pressure on US equities. Goldman Sachs has identified 13 stocks that should outperform the broader market as tensions rise. ✔ Getty/Scott Olson President Donald Trump has once again upped the stakes of a global-trade showdown with China, which could put pressure on US equities particularly stocks with high overseas exposure ✔ Verizon Communications Markets Insider Ticker: VZ Industry: Telecom Market cap: $218 billion % of US sales: 100% Source: Goldman Sachs 3/ 15

Oil Prices Fall as Trade Tensions Ramp Up

Oil prices fell as investors sold down their stakes following a recent price rally and amid concerns about the brewing U.S.-China trade war ✔ Experts worried the simmering commercial fights could boil over, slow economic growth and put a dent on consumer appetite for oil ✔ Nymex reformulated gasoline blendstockthe benchmark gasoline contractfell 1.99% to $0.76 a gallon ✔ ICE gasoil changed hands at $686.00 a metric ton, down $2.00 from the previous settlement

U.S. funds raise cash in August on trade worries: Reuters poll

U.S. fund managers recommended an increase in cash holdings this month to a three-year high and a cut to equities as persistent concern about a U.S.-China trade war sent stock markets see-sawing, a Reuters poll showed. ✔ FILE PHOTO: A sheet of United States one dollar bills is seen on a light table during production at the Bureau of Engraving and Printing in Washington November 14, 2014 ✔ Average month-to-month allocation changes in Reuters polls are usually slight ✔ Our Standards:The Thomson Reuters Trust Principles

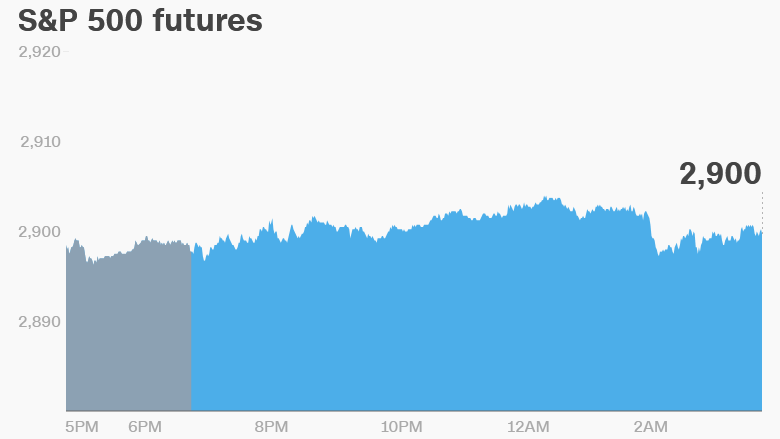

Stock futures flat ahead of Labor Day; major indexes set for strong week and month

U.S. stock-index futures were little changed on Friday, as investors once again confronted the prospect of a trade war with other major economies, following reports that President Donald Trump was likely to push forward with tariffs against China. ✔ Late Tuesday, Canadian Foreign Minister Chrystia Freeland met with Trump administration officials in an attempt to resolve testy discussions between the two countries on trade, coming on the heels of the U.S. and Mexico’s announcement of progress toward a bilateral trade agreement that may ultimately result in a retooling of the trilateral North American Free Trade Agreement

World shares fall for second day as Trump makes fresh trade threats

Global stocks fell for a second day on Friday as a report that U.S. President Donald Trump was preparing to step up a trade war with Beijing dampened risk appetite and erased some of the gains made in a rally this week. ✔ REUTERS/Suzanne Plunkett/File photo Bloomberg News reported on Thursday that Trump is ready to impose tariffs on $200 billion more in Chinese imports as soon as a public comment period on the plan ends next week ✔ In European trade, it was 0.2 percent higher at 110.47 per dollar JPY= ✔ The euro was 0.1 percent higher at $1.1683 EUR=, having shed 0.33 percent in the previous session ✔ Our Standards:The Thomson Reuters Trust Principles

NK blames US for deadlock in denuke talks

undefined ✔ The U.S. should play its role in carrying out the historic joint statement reached between the U.S. and North Korea, not focus on military gambling, which does more harm than good, it said ✔ The outlet also referred to the U.S. resuming sanctions on Iran after leaving the Iran nuclear deal

UK funds lift equity exposure, favor EMs after shake-out

British investors increased their equity exposure in August from July's nine-month lows, favoring emerging markets after a shake-out in the sector, but cut UK assets as the risk of a no-deal Brexit grew. ✔ The lira TRY= is now down over 40 percent year-to-date, crushed by Turkey's loose monetary and fiscal policy and a diplomatic rift with the United States ✔ But poll participants who answered a question on the currency’s travails were split over whether the lira had troughed ✔ Our Standards:The Thomson Reuters Trust Principles

‘Not good enough’: Trump rejects EU offer to dump auto tariffs

US President Donald Trump has refused an offer from the European Union to scrap tariffs on mutual imports of vehicles, saying the proposal is a one-sided deal favoring Europe. ✔ On Friday, Juncker told German broadcaster ZDF that the EU would not let anyone determine its trade policies ✔ He said that if Washington violated the deal reached in July and imposed auto tariffs then we will also do that ✔ For more stories on economy & finance visit RT's business section

Coke gets some coffee; Tencent tumbles; NAFTA deal?

Here's what you need to know about the markets before you start your business day. ✔ Costa has nearly 4,000 stores across 32 countries ✔ But investors are worried that a major escalation in the fight between the United States and China may be just around the corner ✔ Coming this week: Friday Eurozone unemployment data released for July

US ports fear tariffs could reduce ship traffic and jobs

Ports and ground terminals in nearly every state handle goods that are now or will likely soon be covered by import tariffs. Port executives worry that this could mean a slowdown in shi ✔ Ports and ground terminals in nearly every state handle goods that are now or will likely soon be covered by import tariffs ✔ The Associated Press analyzed government data and found that from the West Coast to the Great Lakes and the Gulf of Mexico, at least 10 percent of imports at many ports could face new tariffs if President Donald Trump's proposals take full effect ✔ Retaliatory duties by China and other countries cover $27 billion in U.S. exports

Stock futures tentative on trade tensions

✔ Would a US-Canada trade deal boost the markets ✔ In overnight corporate news, Coca-Cola is increasing its caffeine quotient with plans to acquire the Costa coffee chain of the UK for $5.1 billion ✔ The Nasdaq Composite fell 21.32 points, or 0.26%, to 8,088.36 ✔ On Friday, traders will get the latest read on consumer sentiment

5 big victims of the emerging market meltdown

Emerging market currencies have taken a battering amid a cocktail of concerns from rising US interest rates to political turmoil. ✔ India's economy isn't showing many signs of weakness just yet, though ✔ Investors fear that more sanctions could be on the way, including measures targeting banks and energy companies ✔ However, some analysts say the rise in oil prices this year should offset much of the damage from the weaker ruble

China plans income tax breaks to boost consumption

China's parliament moved on Friday to raise the threshold for collecting income taxes, the first major adjustment in seven years, in a bid to boost incomes and personal spending power in a slowing economy. ✔ The income tax amendment will significantly boost consumption and cut tax revenue by about 320 billion yuan per year, vice finance minister Cheng Lihua told a news conference ✔ ($1 = 6.8327 Chinese yuan renminbi) Our Standards:The Thomson Reuters Trust Principles

Global economy CRISIS: Argentina peso, India rupee and Turkey lira currencies PLUMMET

CURRENCIES in Turkey, India and Argentina have plummeted sparking fears of a global economy crash. ✔ Over time, inflation has led to the lira spiralling and investors losing faith in Turkey’s fiscal discipline ✔ With heightened trade tensions threatening to erupt into a full-blown trade war, the region is on alert for disorderly capital outflows that could lead to financial instability, especially in countries that have high external debt levels

5 things economists say Trump doesn't get about trade

They argue that some of his cornerstone negotiating tactics, especially tariffs, are based on misconceptions ✔ Given the strength of the U.S. economy relative to our trading partners, it's to be expected that our trad deficit will rise ✔ Overall, this myth is only half-true; the US has lower tariffs than most partners, but not by an extreme margin and with many major partners the differences are negligible

10 things you need to know before the opening bell

This is what traders are talking about. ✔ Cboe is telling market makers that it's getting close to launching ether futures ✔ Chicago PMI and University of Michigan consumer confidence will cross the wires at 9:45 a.m. ET and 10 a.m. ET, respectively ✔ The US 10-year yield is down 1 basis point at 2.85%

Danger to oil demand from trade wars may offset price boost from...

Oil analysts cut their price forecasts for 2018 for the first time in almost a year in August, given growing concern over the impact on crude demand from escalating trade tensions, although falling supply, particularly from Iran, would likely limit losses, a Reuters poll showed on Friday. ✔ The United States wants to force buyers of Iranian oil to cut their imports from OPEC’s third-largest producer to nothing, after an international nuclear deal between the two nations was dissolved ✔ However, there is a concern among analysts that global trade disputes could undermine economic growth, which in turn may mean Asian importers’ demand for crude oil declines ✔ Our Standards:The Thomson Reuters Trust Principles

Some nations are the authors of their own misfortune

undefined ✔ Emerging market woes add up to more than tariffs and fear of a trade war ✔ The famous example of the UK’s Black Wednesday in 1992, when base rates were moved from 10 per cent to15 per cent in a matter of hours, shows the problem with this approach ✔ Markets responded with disbelief that the government could go through with a measure that would be so painful for the economy

European shares fall on renewed fear of trade conflict

European shares fell for a second day on Friday on reports that U.S. President Donald Trump is planning more tariffs on China, while Whitbread surged after clinching a $5.1 billion deal with Coca-Cola. ✔ Sage (SGE.L) tumbled 9 percent, the biggest decline among European stocks, after the British software developer surprised the market by announcing Chief Executive Stephen Kelly would stand down in May next year ✔ Our Standards:The Thomson Reuters Trust Principles

Indonesia rupiah nears 1998 crisis levels, central bank intervenes...

Indonesia's central bank stepped up currency and bond intervention on Friday to defend the rupiah, as contagion from an emerging market sell-off pushed the currency close to levels not seen since the Asian financial crisis. ✔ Nanang Hendarsah, BI’s head of monetary management, said the central bank was decisively intervening to support the rupiah and halt a fall in bond prices, citing the purchase on Friday of 3 trillion rupiah ($203.74 million) of bonds sold by foreign investors

Dollar steadies as euro hit by U.S. trade tariff concerns

The euro fell on Friday on anxiety about an escalating trade conflict between the U.S. and the European Union. ✔ REUTERS/Gary Cameron/File Photo The euro has strengthened in recent sessions partly due to easing concerns about a global trade war denting the dollar’s safe-haven appeal ✔ The cautious mood helped lift the yen, which rose 0.6 percent on Thursday, its biggest daily rise in about six weeks ✔ On Friday it was up 0.2 percent at 110.785 per dollar JPY=D3 ✔ Our Standards:The Thomson Reuters Trust Principles

U.S. oil retreats from $70 in August’s final session; rig count ahead

Crude-oil futures early Friday retreat from their highest levels in about six weeks, but the commodity is set for a weekly advance as investors watch for a final inventory report to wrap up trade in August. ✔ That followed a drop of 5.8 million barrels reported by the EIA the week before ✔ Bloomberg on Thursday reported that Trump wants to move ahead with his plan to place tariffs on $200 billion in additional Chinese imports as early as next week ✔ The September contracts expire at Friday’s settlement ✔ October natural gas NGV18, +1.18% meanwhile, added 1% to $2.903 per million British thermal units, up 0.4%

America's Economic Wars Will End in Disaster Same as Its Military Adventures

It seems that the Chinese leadership has concluded that the Trump Administration is determined to use its full spectrum radical leverage to hobble China as a rival, and to resurrect its own global domination – Xi seems to foresee a long struggle for position in the global future: one that will be played out geo-politically (in the jostling in the South China Sea, over North Korea, Taiwan and the BRI), as much as in the economic domain. ✔ China has always been wary of disrupting markets – that is true ✔ It will either soon exhaust itself, or will result in a contagious credit crisis (with Europe likely the prime victim), triggered precisely by the liquidity-drought engineered to give Trump more leverage

Investors in China prepare for MSCI part-2, armed with wishlist

The inclusion of Chinese stocks in MSCI's benchmark indexes this year has made mainland equities more attractive to foreign buyers, but exposure to global investment has also revealed some rough edges around corporate China's governance standards. ✔ While active fund managers have leeway in allocating funds to China, whose main index .SSEC is down 17 percent this year, mangers of passive portfolios that track the MSCI indexes will have to include the roughly 230 Chinese companies in the benchmark

Global funds raise stock allocations to four-month high

Global investors raised their equity holdings to four-month highs in August, favoring Japan, a Reuters poll showed on Friday, with two-thirds also saying it was time to go back into emerging markets after another sell-off there. ✔ Brazil's real BRL=, China's yuan CNY= and the South African rand ZAR=D3 came under sustained pressure as well ✔ MASSIVE LOSSES Investors were divided over whether the lira had reached a trough after plummeting more than 40 percent year-to-date ✔ Our Standards:The Thomson Reuters Trust Principles

>>> Open This Series

Comments

Post a Comment